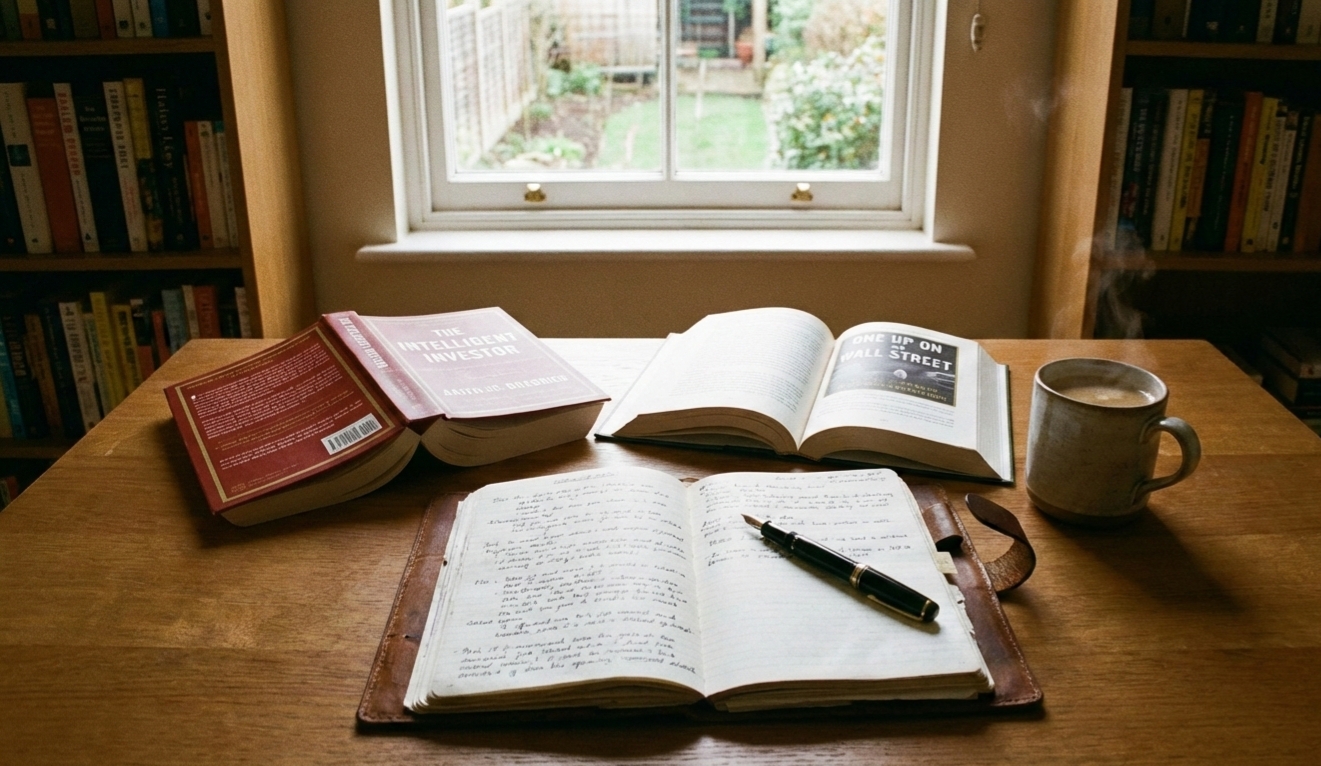

The stock market often appears distant and intimidating—full of charts, jargon, and sudden swings that seem to reward insiders alone.

For beginners, the hardest step is not investing money; it is learning how to think. The right books can slow the noise, explain the basics without condescension, and replace fear with structure. This guide explores books that help you understand the stock market, written for clarity rather than hype, patience rather than prediction.

Why Books Still Matter for Stock Market Learning

Online tips change daily. Algorithms chase trends. Books, on the other hand, teach principles. They explain why markets behave the way they do, how risk works, and what discipline looks like over decades. For beginners, this foundation matters more than any “hot stock.”

The Best Books That Help You Understand the Stock Market

1. The Intelligent Investor by Benjamin Graham

Summary (Beginner-Friendly):

This classic focuses on protecting capital first and growing it steadily over time. It explains the difference between investing and speculation, teaching readers to value businesses rather than chase prices.

Key Lessons & Themes:

- Margin of safety matters more than quick profits

- Emotional discipline beats market timing

- Stocks represent ownership, not lottery tickets

Author in Brief:

Benjamin Graham is considered the father of value investing and a mentor to Warren Buffett.

My Reflection:

This book does not rush the reader. It asks for patience and rewards it with clarity. Reading it feels like sitting with a calm teacher while the market outside shouts.

Short Quotes:

- “Risk comes from not knowing what you’re doing.”

- “The investor’s chief problem is likely to be himself.”

- “Price is what you pay; value is what you get.”

2. One Up On Wall Street by Peter Lynch

Summary:

Lynch explains how ordinary investors can succeed by observing everyday businesses they already understand—before Wall Street notices them.

Key Lessons:

- Simple ideas often work best

- Research beats rumors

- Long-term holding rewards conviction

Author in Brief:

Peter Lynch managed the Fidelity Magellan Fund, achieving legendary returns.

My Reflection:

This book removes the myth that investing requires genius. It suggests attentiveness is enough.

Short Quotes:

- “Know what you own, and why you own it.”

- “Investing without research is like poker without cards.”

3. A Random Walk Down Wall Street by Burton G. Malkiel

Summary:

This book argues that markets are largely unpredictable and that low-cost index investing often outperforms active trading.

Key Lessons:

- Market efficiency limits prediction

- Diversification reduces risk

- Long-term indexing is powerful

My Reflection:

This book brings humility. It teaches acceptance rather than control—a rare but necessary lesson.

Short Quotes:

- “Blindfolded monkeys could pick stocks as well as experts.”

- “Time in the market beats timing the market.”

4. The Little Book of Common Sense Investing by John C. Bogle

Summary:

Bogle advocates simple index funds, low fees, and steady investing over speculation.

Key Lessons:

- Costs matter more than complexity

- Simplicity often wins

- Compounding rewards patience

Author in Brief:

John Bogle founded Vanguard and revolutionized index investing.

My Reflection:

This book feels like financial minimalism—quiet, focused, and surprisingly reassuring.

Short Quotes:

- “Don’t look for the needle. Buy the haystack.”

- “Time is your friend; impulse is your enemy.”

5. The Psychology of Money by Morgan Housel

Summary:

Rather than formulas, this book explores how behavior, emotions, and life experiences shape financial decisions.

Key Lessons:

- Luck and risk coexist

- Wealth is about freedom, not appearance

- Emotional control matters more than intelligence

My Reflection:

This book feels deeply human. It explains why smart people still make poor financial choices—and how awareness can change that.

Short Quotes:

- “Getting money is one thing. Keeping it is another.”

- “The hardest skill is getting the goalpost to stop moving.”

Quick Takeaway Table

| Book Title | Best For | Core Idea |

|---|---|---|

| The Intelligent Investor | Safety-first beginners | Value over price |

| One Up On Wall Street | Curious observers | Invest in what you know |

| Random Walk Down Wall Street | Passive investors | Indexing works |

| Common Sense Investing | Long-term planners | Low cost, low stress |

| Psychology of Money | Emotional clarity | Behavior drives results |

Pros and Cons of Learning Through Books

Pros:

- Builds strong mental models

- Encourages long-term thinking

- Reduces emotional mistakes

Cons:

- Requires patience

- Less excitement than quick tips

- Results are gradual, not instant

Conclusion: Understanding Before Earning

The market does not reward urgency; it rewards understanding. These books that help you understand the stock market do not promise shortcuts. Instead, they offer something more durable: clarity, patience, and confidence. For beginners, this knowledge becomes a quiet advantage—one that compounds far beyond numbers.

FAQs

1. Are these books suitable for complete beginners?

Yes. They explain concepts slowly and focus on mindset as much as mechanics.

2. Do I need financial math skills?

No advanced math is required—only basic understanding and patience.

3. Should I read all of them?

Start with one. Each book adds a different perspective.

4. Are these books relevant today?

Yes. Principles outlast market cycles.

5. Can these books help avoid losses?

They help reduce avoidable mistakes, not eliminate risk.

6. Are these books about trading?

No. They focus on investing, not short-term trading.

Thank you for reading!

Stay tuned for more inspiring Books summary, Author spotlight, Trend Books & more get full information on TheBooksx.com