Money rarely changes a person’s mindset. More often, it reveals it.

Some people earn more and still feel poor. Others earn less and steadily build wealth. The difference is not luck, education, or background. It is the way money is understood, felt, and handled internally. Wealth, long before it appears in bank accounts, forms as a mental framework.

The books explored here do not promise shortcuts or overnight riches. Instead, they quietly expose how the wealthy think about money—how they relate to risk, patience, value, and long-term thinking. These books focus on the psychology of wealth, not the illusion of it.

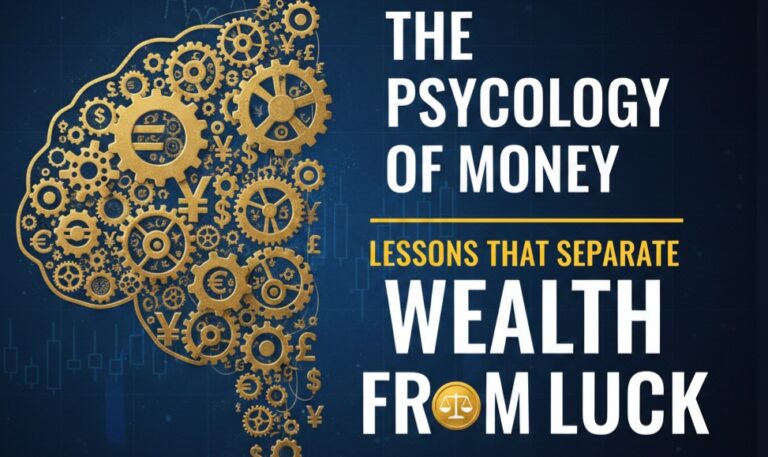

1. The Psychology of Money – Morgan Housel

Book Summary

This book explores how emotions, personal history, and behavior influence financial decisions more than intelligence or technical knowledge. Through simple stories and real-world examples, it explains why people make irrational money choices and how long-term wealth is built through discipline and patience.

Key Lessons

- Wealth is more about behavior than knowledge

- Compounding rewards patience, not brilliance

- Financial success depends on avoiding big mistakes, not making perfect moves

Author Snapshot

Morgan Housel is a former financial columnist known for translating complex financial ideas into human stories grounded in psychology.

Personal Reflection

This book feels honest in a way most finance books are not. It does not judge failure or glorify success. Instead, it reminds that everyone plays a different financial game, shaped by unseen experiences. It quietly changes how money decisions feel—less like pressure, more like responsibility.

2. Rich Dad Poor Dad – Robert T. Kiyosaki

Book Summary

Through the contrast of two father figures, this book explains the difference between working for money and making money work for you. It challenges traditional beliefs about jobs, savings, and security.

Key Lessons

- Assets put money in your pocket; liabilities take it out

- Financial education matters more than income

- The rich focus on ownership, not wages

Author Snapshot

Robert Kiyosaki is an entrepreneur and educator who popularized financial literacy concepts for everyday readers.

Personal Reflection

This book creates discomfort—and that is its strength. It forces a rethinking of ideas passed down as “safe advice.” Whether one agrees with every idea or not, it permanently alters how income and freedom are perceived.

3. Think and Grow Rich – Napoleon Hill

Book Summary

Based on years of interviews with wealthy individuals, this classic explores the mental principles behind success, focusing on belief, desire, and persistence.

Key Lessons

- Wealth begins with clarity of purpose

- Belief shapes behavior before results appear

- Persistence outlasts talent

Author Snapshot

Napoleon Hill was a self-help pioneer whose work influenced modern success psychology.

Personal Reflection

Despite its age, this book feels timeless. It does not discuss money directly as much as it examines the inner mechanics of ambition. The language may feel old, but the mindset remains relevant.

4. The Millionaire Next Door – Thomas J. Stanley & William D. Danko

Book Summary

This book reveals that most millionaires live quietly, spend carefully, and avoid status-driven lifestyles.

Key Lessons

- Wealth grows through discipline, not display

- High income does not equal high net worth

- Frugality is a long-term strategy

Personal Reflection

The book gently dismantles the image of wealth portrayed online. It replaces flash with consistency and patience, showing that real wealth often goes unnoticed.

5. Secrets of the Millionaire Mind – T. Harv Eker

Book Summary

This book focuses on money “blueprints” formed during childhood and how they influence financial outcomes.

Key Lessons

- Internal money beliefs shape external results

- Awareness allows reprogramming of habits

- Wealth is a learned skill

Personal Reflection

This book reads like a mirror. Some ideas feel uncomfortable because they expose inherited beliefs rarely questioned. It emphasizes that earning more means thinking differently first.

Best Quotes from These Books

- “Doing well with money has little to do with how smart you are.” — Morgan Housel

- “The poor and middle class work for money. The rich have money work for them.” — Robert Kiyosaki

- “Whatever the mind can conceive and believe, it can achieve.” — Napoleon Hill

- “Wealth is what you don’t see.” — Thomas J. Stanley

- “Your money blueprint determines your financial life.” — T. Harv Eker

Quick Takeaway Table

| Book Title | Core Idea | Best For |

|---|---|---|

| The Psychology of Money | Behavior over intelligence | Long-term thinkers |

| Rich Dad Poor Dad | Assets vs liabilities | Beginners |

| Think and Grow Rich | Mindset mastery | Vision-driven readers |

| The Millionaire Next Door | Quiet wealth | Practical planners |

| Secrets of the Millionaire Mind | Belief reprogramming | Mindset shifters |

Pros & Cons

Pros

- Focus on mindset, not hype

- Applicable across income levels

- Long-term psychological value

Cons

- Some concepts repeat across books

- Not step-by-step investment guides

- Requires reflection, not quick action

Conclusion: Wealth Is Learned Before It Is Earned

These books do not promise instant wealth. Instead, they quietly reshape how money is understood. They teach patience over urgency, ownership over appearance, and clarity over impulse.

The rich do not think about money constantly. They think about systems, time, and behavior. These books help build that internal structure—slowly, realistically, and permanently.

FAQs

1. Are these books suitable for beginners?

Yes. Most focus on mindset rather than technical finance.

2. Do these books teach investing strategies?

They focus more on thinking patterns than specific investments.

3. Which book should be read first?

The Psychology of Money offers the most balanced starting point.

4. Are these books still relevant today?

Yes. Human behavior around money has not changed.

5. Can mindset alone make someone rich?

Mindset shapes decisions; decisions shape outcomes.

6. Are these books repetitive?

Some ideas overlap, reinforcing core principles.

Thank you for reading!

Stay tuned for more inspiring Books summary, Author spotlight, Trend Books & more get full information on TheBooksx.com