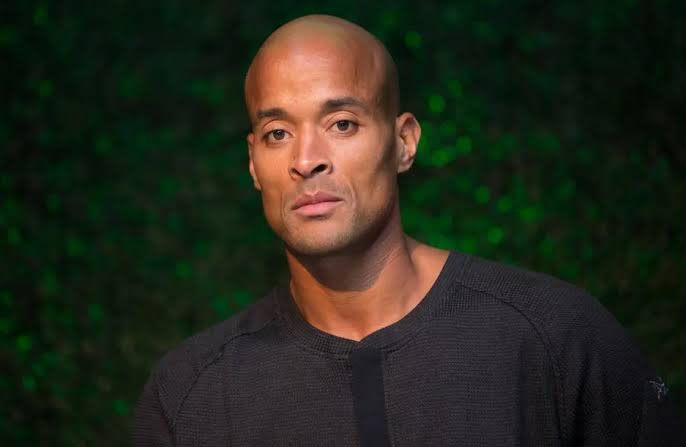

If you’ve ever typed “how to get rich” into Google, chances are you’ve stumbled across Rich Dad Poor Dad. The book is everywhere — and so is the name Robert Kiyosaki. But here’s the part most people skip over: before he was selling millions of books and standing on stage in front of crowds, Robert was failing. A lot.

And not quiet failures. Big ones — bankrupt businesses, broke bank accounts, and more than one moment of thinking: “What now?”

That’s what makes his story worth telling. Not because he got rich — lots of people do. But because he learned how, failed loudly, and then taught others what he learned in a way they could actually understand.

Let’s rewind the tape.

| Detail | Information |

|---|---|

| Name | Robert Kiyosaki |

| Date of Birth | April 8, 1947 |

| Age | 78 (as of 2025) |

| Nationality | American |

| Profession | Author, Entrepreneur, Investor |

| Famous For | Rich Dad Poor Dad |

| Spouse | Kim Kiyosaki |

| Net Worth | Approx. $100 million (2025 est.) |

Two Dads, Two Roads

Robert was born in 1947, in Hilo, Hawaii — back when it still felt more like an island village than a U.S. state. His biological dad, Ralph Kiyosaki, was the classic definition of a “good man.” Educated, smart, and working in Hawaii’s education system. He had degrees, a steady job, and the respect of his peers.

But money? That was always tight.

Then there was the father of one of Robert’s childhood friends — a guy who didn’t finish high school but seemed to understand money like it was second nature. He ran businesses, bought property, and talked about cash in a way schools never did. Over time, Robert started learning from him too.

These two men became the foundation of Robert’s future message: one dad had academic smarts but struggled financially. The other, less educated, built wealth.

Robert eventually gave them nicknames: Poor Dad and Rich Dad.

Discipline First: The Marine Corps Days

After high school, Robert didn’t head into business school like you’d expect. Instead, he enrolled in the U.S. Merchant Marine Academy, graduated in 1969, and went off to serve as a helicopter pilot during the Vietnam War. It was intense, dangerous work, but he came out of it with something he credits to this day: discipline, and the guts to face risk.

That military training didn’t just make him tough — it taught him how to stay calm under pressure. Pretty handy when your first few businesses go belly-up.

The Xerox Chapter — Good Pay, Wrong Path

After leaving the Marines, Robert took a job at Xerox, selling copiers. And he was good at it — even climbing the ranks as one of their top salesmen. But here’s the thing: the better he did, the more restless he felt.

Why? Because he was trading time for money. And deep down, he already knew that wasn’t the game he wanted to play.

So, like many entrepreneurs do, he quit.

First Business… First Big Mess

His first real swing at business was with Velcro surfer wallets — yes, those colorful, flashy wallets people carried in the ‘80s. For a while, it looked like he’d nailed it. The wallets were getting media coverage, stores were interested, and it seemed like things were taking off.

But they weren’t built to last — literally. The quality didn’t hold up, and Robert admits they didn’t really know how to run operations properly. Eventually, the business folded.

Was it humiliating? Yeah. But was it also a better lesson than any MBA course? Definitely.

The Setbacks Keep Coming

Most people would’ve thrown in the towel after that first business failed. But not Robert. He kept pushing. His next venture was in the t-shirt world—selling band merchandise and concert gear. That business, too, crumbled. By the late ’80s, Robert and his wife, Kim, were practically broke. They were even sleeping in their car at one point.

Not exactly the picture of success.

But this is the part of Robert’s life that most people miss. Before the books and seminars and YouTube interviews, he was just another guy trying and failing. But instead of running away from those failures, he leaned into them.

Teaching Others What He Learned the Hard Way

After hitting what he describes as rock bottom, Robert had a lightbulb moment. What if he took everything he had learned from his failures, from his two “dads,” and from the real world, and started teaching it?

No textbooks. No fluff. Just real talk about money, debt, assets, and the stuff no one ever teaches you in school.

He started small—hosting financial education workshops and speaking at events. Word began to spread. People were hungry for this kind of talk—plain, straight-up advice on how to think about money.

The Book That Changed Everything

In 1997, he self-published a little book called Rich Dad Poor Dad. At first, it was a slow burn. But then it started catching fire. Friends told friends. Families passed it around. The message was simple but powerful: the rich think differently about money, and you can learn to think like them too.

It wasn’t about how to get rich quick. It was about understanding cash flow, the difference between assets and liabilities, and how to stop living paycheck to paycheck.

Rich Dad Poor Dad became more than a book—it became a movement. To date, it’s sold over 40 million copies and been translated into dozens of languages.

The Rich Dad Brand is Born

Once the book took off, Robert did what any savvy entrepreneur would do—he built a brand. He followed up with more books like Cashflow Quadrant, Rich Dad’s Guide to Investing, and Increase Your Financial IQ.

He even created the CASHFLOW board game, which is basically Monopoly with a purpose. It’s designed to teach people how to invest, manage expenses, and understand cash flow—all through play.

Alongside his wife Kim, he also launched workshops, online courses, and speaking tours. Rich Dad became more than a person—it became a platform for financial literacy.

His Core Philosophy: Don’t Work for Money

At the heart of everything Robert teaches is a simple idea: Don’t work for money—make money work for you.

It sounds like a catchy slogan, but he means it. Most people, he argues, spend their whole lives working jobs to earn a salary, only to spend that salary on stuff they don’t need. That cycle—earn, spend, repeat—keeps them trapped.

Instead, he teaches people to focus on buying assets. These are things like real estate, stocks, businesses—things that generate money, not eat it.

And avoid liabilities, even if they look like success (like fancy cars or big houses that drain your income).

Not Everyone’s a Fan

Of course, not everyone agrees with Kiyosaki. Some financial experts say his advice is too simplistic or too risky. Others have questioned whether his “Rich Dad” was even a real person—Robert’s never revealed who he was, which has led to lots of speculation.

He’s also gotten heat over the years for the companies that run his seminars. In 2012, one of his companies, Rich Global LLC, filed for bankruptcy after losing a lawsuit. Critics said some of the paid seminars were misleading or overly aggressive in upselling people.

But Robert? He doesn’t back down. He’s always said that failure is part of success, and that he’d rather speak plainly—even if it ruffles feathers—than sugarcoat the truth about money.

Today: Crypto, Gold, and Constant Warnings

These days, Kiyosaki is still at it. He’s very active online—especially on X (formerly Twitter)—where he regularly posts about the economy, government debt, inflation, and why people should prepare for financial storms.

His current go-to investments?

- Gold and silver: “Real money,” as he calls it.

- Bitcoin: A hedge against what he sees as a shaky global financial system.

- Real estate: Still his favorite way to generate cash flow.

He’s also become more of a public commentator on global economics. Love him or hate him, people pay attention when he talks.

His Impact and Why He Still Matters

Whether you’re into finance or not, it’s hard to deny Robert Kiyosaki’s impact. He took the mystery out of money and explained it in a way anyone could understand.

He didn’t preach about budgets or cutting lattes. He taught people to think about ownership, cash flow, risk, and mindset. And that shift—thinking like an investor instead of an employee—is what changed lives.

Final Thoughts: Why His Story Sticks

Kiyosaki’s story isn’t a straight line. It’s messy. He failed, got back up, and then helped millions learn from what he went through.

He’s not your typical finance guy in a suit quoting market stats. He’s more like the blunt uncle who tells you the stuff your teacher never would—like how your house might actually be a liability, or why job security can be a trap.

At the end of the day, that’s why his message works.

Because it’s real.

Because it’s different.

Because it’s needed.

“Don’t let school interfere with your education.” That’s a Mark Twain quote Robert loves to repeat. And in many ways, it sums up his life: he learned by doing, by falling, and by building something from scratch.

And that’s a lesson worth paying attention to.